The Timeless Wisdom of Benjamin Graham: The Intelligent Investor

Why Every Aspiring Investor Should Embrace Value Investing

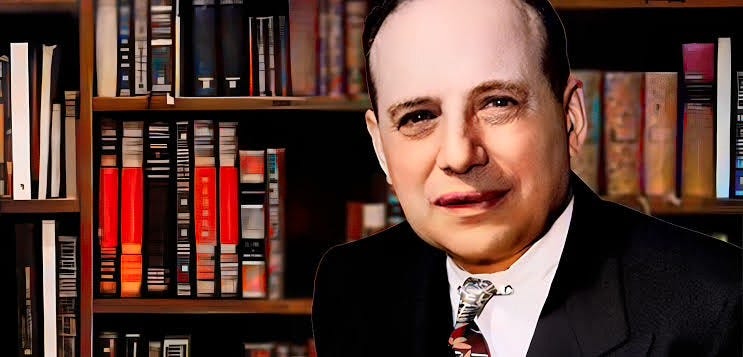

Benjamin Graham, renowned value investor and author of The Intelligent Investor, has left an indelible mark on the world of investing. Originally published in 1949, the book has been hailed by Warren Buffett as the best book on investing ever written. Buffett, a student of Graham at Columbia University and later an employee at Graham-Newman Corporation, attributes much of his success to Graham's teachings. In this article, we delve into the key aspects of The Intelligent Investor and explore the timeless wisdom it offers

.

The Foundation of Intelligent Investing

Graham's central thesis is the distinction between investment and speculation. He asserts that to be an intelligent investor, one must be patient, disciplined, and eager to learn new things. Crucially, investors must also control their emotions and think independently. According to Graham, intelligent investing consists of three core principles:

Thorough Analysis: Conducting a comprehensive evaluation of a company's fundamentals.

Protection Against Losses: Implementing strategies to safeguard investments from severe losses.

Seeking Adequate Performance: Aiming for reasonable returns rather than extraordinary gains.

Graham emphasizes that money is not made by following market trends or buying stocks solely because their prices have risen. Instead, he argues that stocks become riskier as their prices increase and less risky as their prices decrease.

The Difference Between Investors and Speculators

Investors and speculators have fundamentally different approaches. Investors base their decisions on established standards of value, such as the price-to-earnings (P/E) ratio. Speculators, on the other hand, rely solely on market prices. Graham suggests that to determine if market trends are influencing your judgment, ask yourself if you would invest in a stock without seeing its chart.

Unlike speculators, intelligent investors are not seeking quick gains. They focus on sustainable, long-term investment goals, immune to short-term market volatility. Graham's advice has stood the test of time, as he accurately predicted the 1973-74 bear market, during which Wall Street lost 37% of its value.

The Rule of Opposites and Market Humility

Graham introduced the "rule of opposites," which posits that the more enthusiastic investors become, the more likely they are to be wrong in the short run. He underscores the unpredictability of the market and the importance of maintaining humility, expecting the unexpected, and managing risk effectively.

Investor Types: Active vs. Passive

The aggressiveness of your portfolio depends on your investor type:

Active or Enterprising Investor: Requires continuous research and active management of stocks, bonds, and mutual funds. This approach demands significant time and energy.

Passive or Defensive Investor: Involves a fixed, low-risk portfolio that runs autonomously, requiring minimal time and effort.

Both approaches are valid, but success hinges on selecting the one that aligns with your personality to ensure consistency and emotional stability.

The Defensive Investor’s Strategy

Graham advises defensive investors to adopt a long-term, low-risk approach, allocating 50% of their capital to bonds or index funds and the remaining 50% to individual stocks. He recommends the following criteria for stock selection:

Avoid small-cap stocks unless part of a diversified small-cap index.

Ensure current assets are at least double current liabilities.

Look for earnings stability over the past decade.

Select companies with a history of paying dividends.

Choose stocks with a P/E ratio no higher than 15 times the average earnings of the past three years.

Multiply the P/E ratio by the price-to-book ratio; if the result is less than 22.5, the stock is reasonably priced.

The Enterprising Investor’s Approach

For enterprising investors seeking higher returns, Graham suggests a more active strategy with these criteria:

Current assets should be at least 1.5 times current liabilities.

Debt must be no more than 110% of working capital.

Earnings per share should be higher than five years ago.

The company must pay a current dividend.

The price-to-book ratio should be less than 1.2.

The P/E ratio must be less than 10.

This approach focuses on value stocks with a significant margin of safety. Enterprising investors should diversify their portfolios, holding at least 20 stocks.

Deep Value Bargain Investing

Graham's deep value bargain strategy seeks companies with current assets exceeding current liabilities. He believed that even if some stocks fail, the overall return could still be positive due to the value of remaining assets. He advised selecting stocks trading at less than 66% of their net current asset value. Research from Salford Business School found that this strategy yielded annualized returns of 19.7% between 1981 and 2005.

The Core Theory: Margin of Safety

At the heart of Graham's philosophy is the margin of safety, the difference between a stock's market price and its intrinsic value. By buying stocks with a margin of safety, investors can protect themselves from market volatility. The market's emotions often cause prices to swing wildly, presenting opportunities for value investors.

Be the Intelligent Investor

Graham's enduring message is that the market is driven by fear and greed. Intelligent investors, however, measure price against value and make decisions based on sound analysis and a margin of safety. By following these principles, investors can achieve long-term success.

Thank you for reading! Please hit the like button, leave any comments below, and subscribe for more insights into the world of investing and trading.

Become a Professional Funded Trader for Less Than $150/Month with These 4 Essential Tools

Ready to take your trading to the next level? Here’s how you can start building your trading career with minimal investment:

Subscribe to Momentum Alpha

Unlock expert trading insights for as low as $9/month (even less with an annual plan). Gain access to actionable trading setups that can help you make smarter decisions in the market.

Get Funded

Start trading with a remote stock prop firm that gives you $20,000 in buying power or more for just a one-time payment of $97. Trade The Pool is the best option to scale your trading.

Trade with the Best Charting Platform

Take your analysis to the next level with TradingView, the most powerful charting software available. Whether you’re a beginner or a pro, TradingView has the tools you need to succeed.

Analyze Your Trades and Improve Daily

Get better every day by reviewing your trades with the TraderSync Trading Journal. Learn from your wins and losses with detailed analytics. Check out the article I’ve written to see how TraderSync can elevate your trading performance.

With over 8 years of market experience, $20k spent on books and courses, and managing multiple six-figure portfolios, these are the tools I would use if I were starting my trading journey today.

Stop waiting and start your journey to becoming a professional funded trader now!

Disclaimer