How to Make Money in Stocks by William O'Neal: Book Summary

The Path to Spectacular Stock Market Returns Using the CAN SLIM Strategy

William O'Neal, founder of the stock brokerage firm William O'Neal & Co. and creator of the CAN SLIM strategy, is also the chairman of Investor's Business Daily. In his book How to Make Money in Stocks, O'Neal presents 100 charts of the best-performing stocks up to 2008, revealing the common attributes that led to their spectacular performance. Some of these stocks skyrocketed 20-fold in just a couple of years. This article offers a summary of the book and a template you can use to achieve similar results.

The acronym CAN SLIM represents seven criteria that O'Neil found common in stocks with the biggest price gains. Here’s a breakdown of each principle:

C - Current Quarterly Earnings:

Look for companies with significant increases in quarterly earnings per share (EPS) compared to the same quarter in the previous year. Ideally, the EPS should be up by at least 25% or more.

A - Annual Earnings Growth:

Companies should have a strong track record of annual earnings growth over the past five years. Look for annual growth rates of 25% or more.

N - New Products, Services, Management, or Price Highs:

Invest in companies that have something new, such as innovative products or services, new management, or are hitting new highs in stock price. New developments can drive a company's growth and increase investor interest.

S - Supply and Demand:

Analyze the supply and demand of the company's stock. Look for stocks with fewer shares outstanding, as this can lead to increased demand and higher prices. Additionally, stocks with strong institutional sponsorship are preferable.

L - Leader or Laggard:

Choose leading stocks in top-performing industries rather than laggards. Leaders tend to have higher relative price strength ratings.

I - Institutional Sponsorship:

Institutional investors, such as mutual funds and pension funds, should be buying the stock. Strong institutional support can be a positive indicator of a stock's potential.

M - Market Direction:

Consider the overall market direction when buying stocks. Use market indicators to determine whether the market is in an uptrend or downtrend. Investing in stocks during a confirmed market uptrend increases the likelihood of success.

Each of these principles helps investors identify potentially strong stocks with the potential for significant price appreciation. The CAN SLIM method emphasizes a combination of fundamental and technical analysis to make informed investment decisions.

Chart Analysis: Key Findings from the Top Performing Stocks

O'Neal's book meticulously examines the charts of 100 high-performing stocks, uncovering key patterns and strategies. The average return per stock was 805%, achieved in an average of 95 weeks, translating to an annualized return of 543%. Here’s a closer look at the six stocks with the highest annualized returns and the common traits they shared:

1. Resorts International

Return: 630% in 24 weeks

Annualized Return: 1365%

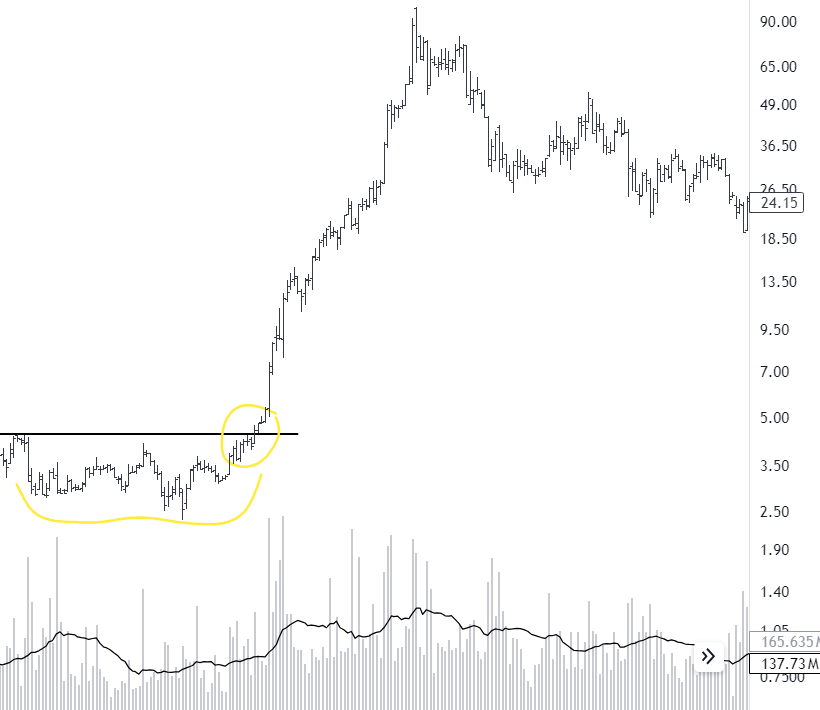

Key Pattern: Cup and handle formation lasting 28 weeks, followed by a breakout.

Risk/Reward: 19 to 1, with a suggested stop-loss just below the small pullback under the resistance line of the wedge.

2. JDS Uniphase

Return: 1946% in 66 weeks

Annualized Return: 1412%

Key Pattern: Cup and handle, with a breakout accompanied by a spike in volume.

Risk/Reward: 16 to 1, with an 8% stop-loss.

3. Northern Pacific

Return: Not specified

Key Pattern: Double bottom and possible cup and handle formation.

Observation: Less clear than other examples but includes breakout from consolidation.

4. Qualcomm

Return: 2091% in 45 weeks

Annualized Return: 2416%

Key Pattern: Cup and handle formation over 24 weeks, with a breakout confirmed by high volume.

Risk/Reward: 23 to 1, with an 8% stop-loss.

5. Yahoo

Return: 6723% in 130 weeks

Annualized Return: 2671%

Key Pattern: Large cup and handle formation over 64 weeks, double bottom within the cup, and low volume in the handle.

Risk/Reward: 30 to 1, with an 8% stop-loss.

6. Taser International

Return: 7223% in 39 weeks

Annualized Return: 2228%

Key Pattern: Cup and handle formation over four months, with a breakout on increased volume.

Risk/Reward: 23 to 1, with an 8% stop-loss.

The Common Attributes of Top Performing Stocks

Cup and Handle Formation: The cup and handle is a consistent pattern among the top performers. The cup's depth should be between 12% and 33% of the stock price, and the handle should show a consolidation with low volume before a breakout.

Volume Spikes: Breakouts from the handle or other formations were often accompanied by a significant increase in volume, indicating strong buying interest.

Risk Management: O'Neal emphasizes a maximum stop-loss position of no more than 8%, allowing for manageable risk and high reward ratios.

The Importance of Risk/Reward Ratio

O'Neal's strategy revolves around achieving high risk/reward ratios. Even with a win rate of just 20%, a risk/reward ratio of 16 to 1 can yield significant returns. For instance, risking $100 with a potential reward of $1600 ensures profitability even with multiple losing trades.

A Practical Example of Risk/Reward

Investment: $10,000 with an 8% stop-loss ($800 risk)

Potential Return: 16 to 1 ratio would yield $12,800 profit

Simulation: Running multiple simulations with a 20% win rate can result in varying returns, with the worst-case scenario still being profitable.

Conclusion

William O'Neal's How to Make Money in Stocks provides a robust framework for identifying high-performing stocks through technical analysis and sound risk management. The CAN SLIM strategy, particularly the cup and handle pattern, has proven effective in generating spectacular returns. By adhering to these principles and maintaining discipline, investors can significantly enhance their chances of achieving similar success in the stock market.

Thank you for reading! Please hit the like button, leave any comments below, and subscribe for more insights and updates on our growing library of investment strategies.

Become a Professional Funded Trader for Less Than $150/Month with These 4 Essential Tools

Ready to take your trading to the next level? Here’s how you can start building your trading career with minimal investment:

Subscribe to Momentum Alpha

Unlock expert trading insights for as low as $9/month (even less with an annual plan). Gain access to actionable trading setups that can help you make smarter decisions in the market.

Get Funded

Start trading with a remote stock prop firm that gives you $20,000 in buying power or more for just a one-time payment of $97. Trade The Pool is the best option to scale your trading.

Trade with the Best Charting Platform

Take your analysis to the next level with TradingView, the most powerful charting software available. Whether you’re a beginner or a pro, TradingView has the tools you need to succeed.

Analyze Your Trades and Improve Daily

Get better every day by reviewing your trades with the TraderSync Trading Journal. Learn from your wins and losses with detailed analytics. Check out the article I’ve written to see how TraderSync can elevate your trading performance.

With over 8 years of market experience, $20k spent on books and courses, and managing multiple six-figure portfolios, these are the tools I would use if I were starting my trading journey today.

Stop waiting and start your journey to becoming a professional funded trader now!

Disclaimer